Welcome to the Dallas Fort Worth International Airport (DFW) Newsroom. Your source for news and information about one of the largest and busiest airports in the world.

For media inquiries, please contact media@dfwairport.com

Stay informed on the latest from DFW

News & Updates

Read the latest news and information about DFW Airport.

Apr 08, 2024

At Dallas Fort Worth International Airport (DFW), Earth Day is not just a date on the calendar; it represents our enduring commitment to sustainability. Far beyond one day, DFW is engaging our community in conversations that matter—about the air we all breathe, the water we all drink and the steps the airport is taking to be a better steward of our planet. From customers passing through, to local North Texans or environmental enthusiasts, DFW is inviting everyone to join our mission of creating a more sustainable world.

Read more

Apr 04, 2024

Dallas Fort Worth International Airport (DFW) has released its 2023 Environmental, Social and Governance (ESG) report. The report provides transparent information and disclosures about DFW’s ESG performance and impact.

Read moreApr 04, 2024

Dallas Fort Worth International Airport (DFW) is implementing adjustments to its parking rates starting May 1, to support ongoing infrastructure and service enhancements. The updated rates are the result of a comprehensive marketplace review to ensure parking products are both competitive and support the airport’s non-aeronautical revenue.

Read more

Mar 11, 2024

For the second-consecutive year, Dallas Fort Worth International Airport (DFW) has been named the best large airport in North America for customer service by Airports Council International (ACI) World.

Read more

Mar 07, 2024

Dallas Fort Worth International Airport (DFW) is gearing up to welcome a record number of passengers this spring break travel season, with an estimated 4.6 million customers between March 7-25.

Read more

Feb 12, 2024

The flowers and bouquets that will be purchased by tens of thousands of people across the North Texas region this Valentine’s Day will be a lot fresher thanks to Dallas Fort Worth International Airport (DFW) and Qatar Cargo.

Read more

Jan 11, 2024

On Jan. 13, 1974, Dallas Fort Worth International Airport (DFW) began operations as the country’s newest and most modern commercial airport, heralding in a new chapter for modern aviation. On Saturday, DFW will recognize its 50th anniversary by beginning a year-long celebration that reflects on the airport’s success, looks ahead to its exciting future and thanks the community for five decades of support.

Read more

Dec 19, 2023

Dallas Fort Worth International Airport (DFW) is expecting 4.5 million customers to travel through the airport between Dec. 14 and Jan. 2. The busiest days are projected to be Friday, Dec. 22, with more than 246,000 customers, Friday, Dec. 15, with more than 244,000 people, and Thursday, Dec. 21, with more than 243,000 travelers. This is 4.8% higher than last year’s winter holiday break, potentially continuing to set holiday travel records. DFW reminds customers to prepare not only for their travel but also for those picking up or dropping off family members as they travel in and out of DFW.

Read more

Nov 19, 2023

Dallas Fort Worth International Airport (DFW) has been selected as one of the 2023 Texan by Nature 20 (TxN 20) honorees. This marks the fifth consecutive year that DFW Airport has been recognized for its commitment to conservation and sustainability.

Read more

Nov 15, 2023

Dallas Fort Worth International Airport (DFW) and Overair – a developer of advanced electric vertical takeoff and landing (eVTOL) aircraft – have announced a memorandum of understanding to cooperatively explore the future of vertiport development and eVTOL aircraft operations within the DFW Metroplex.

Read moreNov 15, 2023

Dallas Fort Worth International Airport (DFW) is ready for what’s expected to be among the busiest winter holiday travel seasons in the airport’s nearly 50-year history.

Read more

Oct 01, 2023

Dallas Fort Worth International Airport (DFW) contributes an estimated $38 billion in direct and indirect payroll support, $24 billion in visitor spending and about $5 billion in state and local tax revenue each year, according to the results of an updated economic impact study released today during the 2023 DFW State of the Airport. The airport also supports more than 634,000 direct and indirect jobs, according to the study.

Read more

Sep 19, 2023

Dallas Fort Worth International Airport (DFW) has kicked off a project that will upgrade the checked baggage equipment in the Terminal D south lobby. As a result, some of the airline check-in counters near the D18 security checkpoint will temporarily relocate. Customers flying on an international airline out of Terminal D will check their bag with their airline before being directed by airline staff to the bag drop-off area near the center of the lobby to complete the check-in process.

Read more

Sep 12, 2023

On Jan. 13, 2024, Dallas Fort Worth International Airport (DFW) will begin a yearlong celebration of 50 years connecting North Texas to the world with an exciting range of special events, activities and surprises throughout the year. Ahead of the 50th anniversary next year, the airport commemorates the community milestone that took place during the third week of September 1973 when the Cities of Dallas and Fort Worth joined with the newly created DFW Airport Board to host a series of dedication events that lasted several days.

Read more

Aug 23, 2023

As part of its ongoing airfield capital improvement program, Dallas Fort Worth International Airport (DFW) has closed one of its east airfield runways to complete routine rehabilitation work that will replace aging infrastructure and create a more efficient operation. Runway 17R/35L closed on Aug. 15, 2023, and is scheduled to reopen in phases beginning summer 2024. This is DFW’s third runway in the past four years to undergo complete rehabilitation, which is a typical part of a runway’s lifecycle.

Read more

Aug 09, 2023

DFW Airport has released its 2022 Environmental, Social and Governance (ESG) report, themed Shaping Tomorrow. The report provides transparent information and disclosures about DFW’s performance and impact on environmental, social and governance issues.

Read more

Aug 08, 2023

As part of its commitment to achieve net-zero carbon emissions by 2030, Dallas Fort Worth International Airport (DFW) today broke ground on the construction of a new, electric Central Utility Plant (eCUP) that will provide sustainably powered heating and cooling capacity to support the growth of DFW Airport. The $234 million facility will be primarily fueled by electricity purchased by the airport that comes from 100% renewable sources.

Read more

Aug 08, 2023

The newest restaurant at Dallas Fort Worth International Airport (DFW) will give customers a one-of-a-kind dining experience crafted by local sports legend Dirk Nowitzki. Nowitzki restaurant celebrated its grand opening today in Terminal C, near Gate C37, with a ribbon-cutting ceremony that featured Nowitzki, who played for 21 seasons in the NBA with the Dallas Mavericks. This new concept celebrates Nowitzki’s Hall of Fame career and offers many of his favorite meals and drinks from around the world while providing a welcoming atmosphere.

Read more

Jul 06, 2023

Passengers departing DFW Airport who arrive at a Transportation Security Administration (TSA) checkpoint now have a faster option for emptying prohibited liquids and preventing unnecessary landfill waste.

Read more

Jul 04, 2023

Dallas Fort Worth International Airport (DFW) has received five Project Achievement awards from the Construction Management Association of America (CMAA) North Texas. Among these recognitions, DFW was named Owner of the Year, commending the Airport's commitment to advancing the construction management industry, supporting professionals, and fostering investment in construction programs.

Read more

Jun 26, 2023

Dallas Fort Worth International Airport (DFW) announced today it is joining the World Economic Forum (WEF) and Airports Council International (ACI) in a new initiative to support the aviation industry’s move to net-zero carbon emissions by 2050. DFW Airport CEO Sean Donohue is among more than 30 industry leaders who have joined The Airports of Tomorrow initiative, which was announced today during the ACI Europe / ACI World Annual General Assembly in Barcelona, Spain.

Read more

Jun 05, 2023

Dallas Fort Worth International Airport (DFW) has announced an agreement with GIANT Innovation to unlock the transformative power of its Everyday Innovator Program for the benefit of airports worldwide. Through this collaboration, DFW aims to share its knowledge and experiences, enabling other airports to build innovation champions within their organizations and revolutionize the experience of its stakeholders.

Read more

May 25, 2023

Memorial Day weekend, the unofficial kickoff to the busy summer travel season, is expected to bring an average of 216,000 passengers each day through DFW.

Read more

May 16, 2023

Dallas Fort Worth International Airport (DFW) and American Airlines today signed a new 10-year Use and Lease Agreement, which includes $4.8 billion in pre-approved capital investments – including the construction of Terminal F, the renovation of Terminal C and other significant modernization projects.

Read more

May 09, 2023

Dallas Fort Worth International Airport (DFW) has been recognized with a Balchen/Post Award honorable mention for Outstanding Achievement in Airport Snow and Ice Control. The award, presented at the 55th Annual International Aviation Snow Symposium in Buffalo, NY, celebrates "Snow Crews" at airports worldwide for their efforts in maintaining safe airfield operations during the 2022-23 winter weather season.

Read more

May 08, 2023

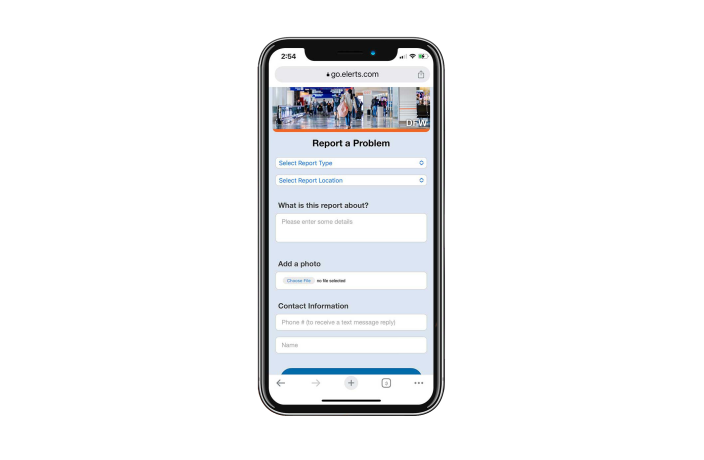

Dallas Fort Worth International Airport (DFW) today announced a new way that travelers can report suspicious activity and operational concerns to Airport authorities using the new “See Say Airport” function. The new service allows anyone to quickly report concerns by visiting telldfw.com, downloading the See Say Airport app at getssairport.com, or simply text a report to 972-534-5550. As always, travelers can dial 9-1-1 to report an active threat directly to law enforcement.

Read more

May 04, 2023

Dallas Fort Worth International Airport has announced a new partnership with Dallas-based AT&T, to provide the airport with a comprehensive wireless platform (CWP) that will enhance connectivity and critical infrastructure.

Read more

May 01, 2023

As part of its ongoing commitment to innovation and sustainability, Dallas Fort Worth International Airport (DFW) will pilot a series of cutting-edge electric vehicle (EV) charging stations in a showcase of new and emerging charging technology.

Read more

Apr 24, 2023

Dallas Fort Worth International Airport (DFW) is beginning a comprehensive redevelopment of the Airport’s 19th Street Cargo facility, which will enhance DFW’s ability to process international e-commerce and increase overall cargo capacity. The project will continue DFW’s growth in cargo operations while applying state-of-the-art technology that addresses labor shortages, airport congestion, and sustainability while increasing safety, efficiency, and security across the cargo ecosystem.

Read more

Apr 11, 2023

Dallas Fort Worth International Airport (DFW) once again holds the title of the world’s second-busiest commercial airport, with 73.4 million passengers passing through the mega-hub in 2022, according to Airports Council International (ACI). DFW’s total passenger traffic last year represents an increase of 17 percent compared with 2021.

Read more

Mar 30, 2023

Dallas Fort Worth International Airport (DFW) welcomed U.S. Secretary of Transportation Pete Buttigieg this morning to celebrate the groundbreaking of the next phase in the Airport’s industry-leading End Around Taxiway (EAT) program. Additionally, the Secretary announced that the Federal Aviation Administration (FAA) would provide a payment of $28.8 million toward construction of the newest EAT on the airport’s southwest side, marking the third of its kind at DFW Airport.

Read more

Mar 17, 2023

Dallas Fort Worth International Airport (DFW) is a dream location for plane spotters given the wide variety of planes overhead each day. Anyone lucky enough to look up at the sky over DFW early on a Sunday, at precisely the right moment, is in for a royal treat. The Queen of the Skies is making her presence known over North Texas as the big cargo hauler sets her sights on DFW Airport, marking the end of her weekly Sunday sojourn here. However, one thing many onlookers likely won’t realize is the significance of this particular Boeing 747. It happens to be the last 747 ever to roll off the assembly line.

Read more

Mar 09, 2023

Dallas Fort Worth International Airport (DFW) is proud to announce that it has been selected as a recipient of $35 million in grant funding from the U.S. Department of Transportation. Through the Airport Terminal Program of the Infrastructure Investment and Jobs Act, this grant will help fund the 2nd phase of the electric Central Utilities Plant (eCUP) and energy enhancements to Terminal D. The two initiatives are part of DFW Airport’s commitment to achieving Net Zero Carbon Emissions by 2030.

Read more

Mar 08, 2023

Dallas Fort Worth International Airport (DFW) has been selected for the 2022 Airport Service Quality (ASQ) award for Best Airport that serves over 40 million passengers in North America by Airports Council International (ACI).

Read more

Mar 06, 2023

Dallas Fort Worth International Airport (DFW) anticipates welcoming over 4.2 million passengers for the Spring Break period from Mar. 2, through Mar. 20. This reflects a 14.3% increase compared to last year and an 11.8% increase when compared to Spring Break 2019. This increase underscores the strong demand for travel. Thanks to DFW’s robust network, customers can satisfy the desire to travel with more than 250 destinations worldwide. Whether it is to a sunny, beachside destination, a snowy mountain retreat, or a bustling big city, DFW delivers many options for that great Spring Break trip.

Read more

Feb 22, 2023

The Dallas Fort Worth International Airport (DFW) Board of Directors has approved a resolution authorizing Hill County, Texas, to join DFW Airport’s Foreign Trade Zone (FTZ) service area. DFW is the official authority of FTZ No. 39, which covers a seven-county service area in North Central Texas. Hill County will be the eighth county to join the zone. FTZs are important to international trade as certain foreign goods within the FTZ can be exempt from Customs duties and certain taxes or defer payments of duties of the goods until they are entered into the market of the United States.

Read more

Jan 31, 2023

Dallas Fort Worth International Airport (DFW) continues to mitigate the impacts of the current winter weather in the area. We remind customers to check with their airline for their flight status before coming to the Airport. TSA Security Operations are limited today.

Read more

Jan 13, 2023

Dallas Fort Worth International Airport (DFW) is celebrating the 49th anniversary of its first commercial airline service. On Jan. 13, 1974, the first airline carrying passengers landed at Dallas Fort Worth Regional Airport.

Read moreStay informed on the latest from DFW

News & Updates

Stay informed on the latest from DFW

News & Updates

Read the latest news and information about DFW Airport.

Apr 08, 2024

At Dallas Fort Worth International Airport (DFW), Earth Day is not just a date on the calendar; it represents our enduring commitment to sustainability. Far beyond one day, DFW is engaging our community in conversations that matter—about the air we all breathe, the water we all drink and the steps the airport is taking to be a better steward of our planet. From customers passing through, to local North Texans or environmental enthusiasts, DFW is inviting everyone to join our mission of creating a more sustainable world.

Read more

Apr 04, 2024

Dallas Fort Worth International Airport (DFW) has released its 2023 Environmental, Social and Governance (ESG) report. The report provides transparent information and disclosures about DFW’s ESG performance and impact.

Read moreApr 04, 2024

Dallas Fort Worth International Airport (DFW) is implementing adjustments to its parking rates starting May 1, to support ongoing infrastructure and service enhancements. The updated rates are the result of a comprehensive marketplace review to ensure parking products are both competitive and support the airport’s non-aeronautical revenue.

Read more

Mar 11, 2024

For the second-consecutive year, Dallas Fort Worth International Airport (DFW) has been named the best large airport in North America for customer service by Airports Council International (ACI) World.

Read more

Mar 07, 2024

Dallas Fort Worth International Airport (DFW) is gearing up to welcome a record number of passengers this spring break travel season, with an estimated 4.6 million customers between March 7-25.

Read more

Feb 12, 2024

The flowers and bouquets that will be purchased by tens of thousands of people across the North Texas region this Valentine’s Day will be a lot fresher thanks to Dallas Fort Worth International Airport (DFW) and Qatar Cargo.

Read more

Jan 11, 2024

On Jan. 13, 1974, Dallas Fort Worth International Airport (DFW) began operations as the country’s newest and most modern commercial airport, heralding in a new chapter for modern aviation. On Saturday, DFW will recognize its 50th anniversary by beginning a year-long celebration that reflects on the airport’s success, looks ahead to its exciting future and thanks the community for five decades of support.

Read more

Dec 19, 2023

Dallas Fort Worth International Airport (DFW) is expecting 4.5 million customers to travel through the airport between Dec. 14 and Jan. 2. The busiest days are projected to be Friday, Dec. 22, with more than 246,000 customers, Friday, Dec. 15, with more than 244,000 people, and Thursday, Dec. 21, with more than 243,000 travelers. This is 4.8% higher than last year’s winter holiday break, potentially continuing to set holiday travel records. DFW reminds customers to prepare not only for their travel but also for those picking up or dropping off family members as they travel in and out of DFW.

Read more

Nov 19, 2023

Dallas Fort Worth International Airport (DFW) has been selected as one of the 2023 Texan by Nature 20 (TxN 20) honorees. This marks the fifth consecutive year that DFW Airport has been recognized for its commitment to conservation and sustainability.

Read more

Nov 15, 2023

Dallas Fort Worth International Airport (DFW) and Overair – a developer of advanced electric vertical takeoff and landing (eVTOL) aircraft – have announced a memorandum of understanding to cooperatively explore the future of vertiport development and eVTOL aircraft operations within the DFW Metroplex.

Read moreNov 15, 2023

Dallas Fort Worth International Airport (DFW) is ready for what’s expected to be among the busiest winter holiday travel seasons in the airport’s nearly 50-year history.

Read more

Oct 01, 2023

Dallas Fort Worth International Airport (DFW) contributes an estimated $38 billion in direct and indirect payroll support, $24 billion in visitor spending and about $5 billion in state and local tax revenue each year, according to the results of an updated economic impact study released today during the 2023 DFW State of the Airport. The airport also supports more than 634,000 direct and indirect jobs, according to the study.

Read more

Sep 19, 2023

Dallas Fort Worth International Airport (DFW) has kicked off a project that will upgrade the checked baggage equipment in the Terminal D south lobby. As a result, some of the airline check-in counters near the D18 security checkpoint will temporarily relocate. Customers flying on an international airline out of Terminal D will check their bag with their airline before being directed by airline staff to the bag drop-off area near the center of the lobby to complete the check-in process.

Read more

Sep 12, 2023

On Jan. 13, 2024, Dallas Fort Worth International Airport (DFW) will begin a yearlong celebration of 50 years connecting North Texas to the world with an exciting range of special events, activities and surprises throughout the year. Ahead of the 50th anniversary next year, the airport commemorates the community milestone that took place during the third week of September 1973 when the Cities of Dallas and Fort Worth joined with the newly created DFW Airport Board to host a series of dedication events that lasted several days.

Read more

Aug 23, 2023

As part of its ongoing airfield capital improvement program, Dallas Fort Worth International Airport (DFW) has closed one of its east airfield runways to complete routine rehabilitation work that will replace aging infrastructure and create a more efficient operation. Runway 17R/35L closed on Aug. 15, 2023, and is scheduled to reopen in phases beginning summer 2024. This is DFW’s third runway in the past four years to undergo complete rehabilitation, which is a typical part of a runway’s lifecycle.

Read more

Aug 09, 2023

DFW Airport has released its 2022 Environmental, Social and Governance (ESG) report, themed Shaping Tomorrow. The report provides transparent information and disclosures about DFW’s performance and impact on environmental, social and governance issues.

Read more

Aug 08, 2023

As part of its commitment to achieve net-zero carbon emissions by 2030, Dallas Fort Worth International Airport (DFW) today broke ground on the construction of a new, electric Central Utility Plant (eCUP) that will provide sustainably powered heating and cooling capacity to support the growth of DFW Airport. The $234 million facility will be primarily fueled by electricity purchased by the airport that comes from 100% renewable sources.

Read more

Aug 08, 2023

The newest restaurant at Dallas Fort Worth International Airport (DFW) will give customers a one-of-a-kind dining experience crafted by local sports legend Dirk Nowitzki. Nowitzki restaurant celebrated its grand opening today in Terminal C, near Gate C37, with a ribbon-cutting ceremony that featured Nowitzki, who played for 21 seasons in the NBA with the Dallas Mavericks. This new concept celebrates Nowitzki’s Hall of Fame career and offers many of his favorite meals and drinks from around the world while providing a welcoming atmosphere.

Read more

Jul 06, 2023

Passengers departing DFW Airport who arrive at a Transportation Security Administration (TSA) checkpoint now have a faster option for emptying prohibited liquids and preventing unnecessary landfill waste.

Read more

Jul 04, 2023

Dallas Fort Worth International Airport (DFW) has received five Project Achievement awards from the Construction Management Association of America (CMAA) North Texas. Among these recognitions, DFW was named Owner of the Year, commending the Airport's commitment to advancing the construction management industry, supporting professionals, and fostering investment in construction programs.

Read more

Jun 26, 2023

Dallas Fort Worth International Airport (DFW) announced today it is joining the World Economic Forum (WEF) and Airports Council International (ACI) in a new initiative to support the aviation industry’s move to net-zero carbon emissions by 2050. DFW Airport CEO Sean Donohue is among more than 30 industry leaders who have joined The Airports of Tomorrow initiative, which was announced today during the ACI Europe / ACI World Annual General Assembly in Barcelona, Spain.

Read more

Jun 05, 2023

Dallas Fort Worth International Airport (DFW) has announced an agreement with GIANT Innovation to unlock the transformative power of its Everyday Innovator Program for the benefit of airports worldwide. Through this collaboration, DFW aims to share its knowledge and experiences, enabling other airports to build innovation champions within their organizations and revolutionize the experience of its stakeholders.

Read more

May 25, 2023

Memorial Day weekend, the unofficial kickoff to the busy summer travel season, is expected to bring an average of 216,000 passengers each day through DFW.

Read more

May 16, 2023

Dallas Fort Worth International Airport (DFW) and American Airlines today signed a new 10-year Use and Lease Agreement, which includes $4.8 billion in pre-approved capital investments – including the construction of Terminal F, the renovation of Terminal C and other significant modernization projects.

Read more

May 09, 2023

Dallas Fort Worth International Airport (DFW) has been recognized with a Balchen/Post Award honorable mention for Outstanding Achievement in Airport Snow and Ice Control. The award, presented at the 55th Annual International Aviation Snow Symposium in Buffalo, NY, celebrates "Snow Crews" at airports worldwide for their efforts in maintaining safe airfield operations during the 2022-23 winter weather season.

Read more

May 08, 2023

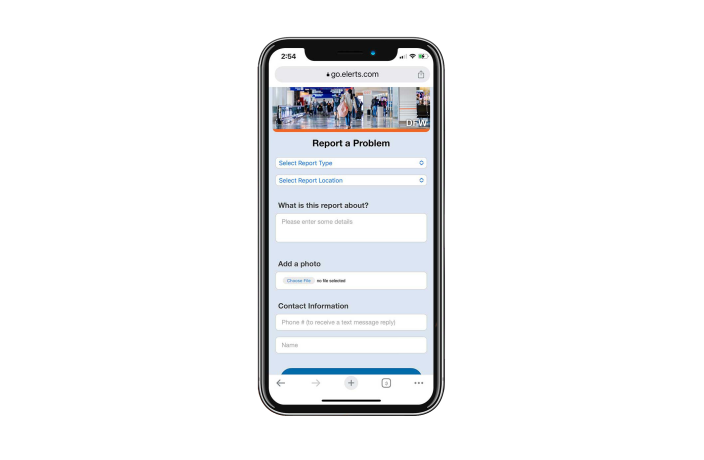

Dallas Fort Worth International Airport (DFW) today announced a new way that travelers can report suspicious activity and operational concerns to Airport authorities using the new “See Say Airport” function. The new service allows anyone to quickly report concerns by visiting telldfw.com, downloading the See Say Airport app at getssairport.com, or simply text a report to 972-534-5550. As always, travelers can dial 9-1-1 to report an active threat directly to law enforcement.

Read more

May 04, 2023

Dallas Fort Worth International Airport has announced a new partnership with Dallas-based AT&T, to provide the airport with a comprehensive wireless platform (CWP) that will enhance connectivity and critical infrastructure.

Read more

May 01, 2023

As part of its ongoing commitment to innovation and sustainability, Dallas Fort Worth International Airport (DFW) will pilot a series of cutting-edge electric vehicle (EV) charging stations in a showcase of new and emerging charging technology.

Read more

Apr 24, 2023

Dallas Fort Worth International Airport (DFW) is beginning a comprehensive redevelopment of the Airport’s 19th Street Cargo facility, which will enhance DFW’s ability to process international e-commerce and increase overall cargo capacity. The project will continue DFW’s growth in cargo operations while applying state-of-the-art technology that addresses labor shortages, airport congestion, and sustainability while increasing safety, efficiency, and security across the cargo ecosystem.

Read more

Apr 11, 2023

Dallas Fort Worth International Airport (DFW) once again holds the title of the world’s second-busiest commercial airport, with 73.4 million passengers passing through the mega-hub in 2022, according to Airports Council International (ACI). DFW’s total passenger traffic last year represents an increase of 17 percent compared with 2021.

Read more

Mar 30, 2023

Dallas Fort Worth International Airport (DFW) welcomed U.S. Secretary of Transportation Pete Buttigieg this morning to celebrate the groundbreaking of the next phase in the Airport’s industry-leading End Around Taxiway (EAT) program. Additionally, the Secretary announced that the Federal Aviation Administration (FAA) would provide a payment of $28.8 million toward construction of the newest EAT on the airport’s southwest side, marking the third of its kind at DFW Airport.

Read more

Mar 17, 2023

Dallas Fort Worth International Airport (DFW) is a dream location for plane spotters given the wide variety of planes overhead each day. Anyone lucky enough to look up at the sky over DFW early on a Sunday, at precisely the right moment, is in for a royal treat. The Queen of the Skies is making her presence known over North Texas as the big cargo hauler sets her sights on DFW Airport, marking the end of her weekly Sunday sojourn here. However, one thing many onlookers likely won’t realize is the significance of this particular Boeing 747. It happens to be the last 747 ever to roll off the assembly line.

Read more

Mar 09, 2023

Dallas Fort Worth International Airport (DFW) is proud to announce that it has been selected as a recipient of $35 million in grant funding from the U.S. Department of Transportation. Through the Airport Terminal Program of the Infrastructure Investment and Jobs Act, this grant will help fund the 2nd phase of the electric Central Utilities Plant (eCUP) and energy enhancements to Terminal D. The two initiatives are part of DFW Airport’s commitment to achieving Net Zero Carbon Emissions by 2030.

Read more

Mar 08, 2023

Dallas Fort Worth International Airport (DFW) has been selected for the 2022 Airport Service Quality (ASQ) award for Best Airport that serves over 40 million passengers in North America by Airports Council International (ACI).

Read more

Mar 06, 2023

Dallas Fort Worth International Airport (DFW) anticipates welcoming over 4.2 million passengers for the Spring Break period from Mar. 2, through Mar. 20. This reflects a 14.3% increase compared to last year and an 11.8% increase when compared to Spring Break 2019. This increase underscores the strong demand for travel. Thanks to DFW’s robust network, customers can satisfy the desire to travel with more than 250 destinations worldwide. Whether it is to a sunny, beachside destination, a snowy mountain retreat, or a bustling big city, DFW delivers many options for that great Spring Break trip.

Read more

Feb 22, 2023

The Dallas Fort Worth International Airport (DFW) Board of Directors has approved a resolution authorizing Hill County, Texas, to join DFW Airport’s Foreign Trade Zone (FTZ) service area. DFW is the official authority of FTZ No. 39, which covers a seven-county service area in North Central Texas. Hill County will be the eighth county to join the zone. FTZs are important to international trade as certain foreign goods within the FTZ can be exempt from Customs duties and certain taxes or defer payments of duties of the goods until they are entered into the market of the United States.

Read more

Jan 31, 2023

Dallas Fort Worth International Airport (DFW) continues to mitigate the impacts of the current winter weather in the area. We remind customers to check with their airline for their flight status before coming to the Airport. TSA Security Operations are limited today.

Read more

Jan 13, 2023

Dallas Fort Worth International Airport (DFW) is celebrating the 49th anniversary of its first commercial airline service. On Jan. 13, 1974, the first airline carrying passengers landed at Dallas Fort Worth Regional Airport.

Read moreStay informed on the latest from DFW

News & Updates